Modeling a Time-Variant Random Variable by Using Drift!¶

[29]:

import pandas_datareader.data as web

from datetime import datetime

import matplotlib.pyplot as plt

import numpy as np

start = datetime(2016, 9, 1)

end = datetime(2021, 8, 31)

ticker = 'AAPL'

stock = web.DataReader(ticker, 'stooq', start, end)

prices = stock.reset_index().sort_values('Date',ascending=True)['Close'].to_numpy()

[30]:

prices

[30]:

array([ 25.027, 25.257, 25.249, ..., 148.6 , 153.12 , 151.83 ])

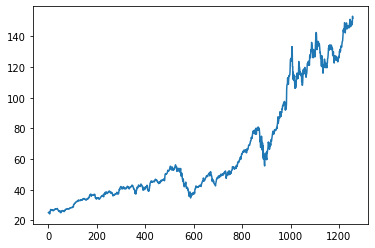

[31]:

plt.plot(prices)

plt.show()

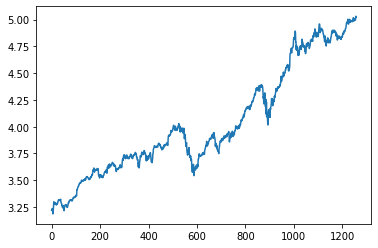

[5]:

logs = np.log(prices)

[6]:

plt.plot(logs)

[6]:

[<matplotlib.lines.Line2D at 0x24398172b50>]

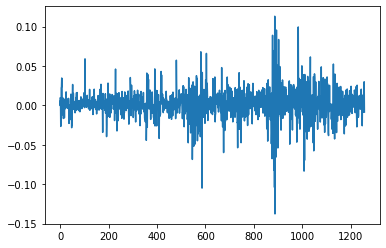

[7]:

first_diff = np.diff(logs)

print(first_diff.mean())

print(first_diff.std())

plt.plot(first_diff)

plt.show()

0.001434213390458498

0.01905342412763582

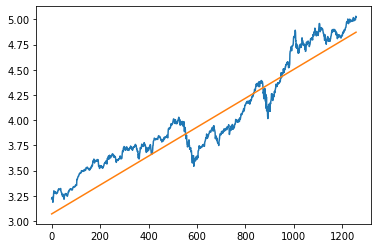

[9]:

avg_return = first_diff.mean()

avg_logs = np.array([logs[0]+avg_return*i for i in range(len(logs))])

plt.plot(logs)

plt.plot(avg_logs-.15)

plt.show()

[10]:

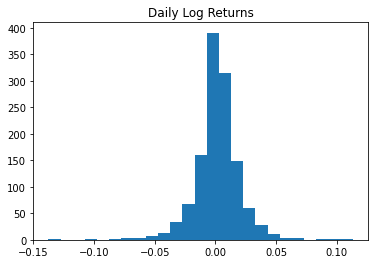

plt.hist(first_diff, bins=25)

plt.title('Daily Log Returns')

plt.show()

[48]:

avg_return

[48]:

0.001434213390458498

[12]:

l = len(prices)

total_return = np.log(prices[-1])-np.log(prices[0])

avg_return = total_return/l

start_exp = np.log(prices[0])

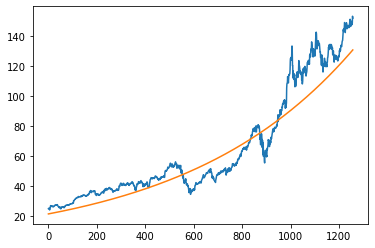

plt.plot(prices)

plt.plot(np.exp(avg_logs-.15))

plt.show()

[50]:

1 - np.exp(1) / np.exp(1+first_diff.mean())

[50]:

0.001433185397946235

[51]:

# An addition of .001 to the exponent translates almost exactly to a .1% increase in value

first_diff.mean()

[51]:

0.001434213390458498

So let’s use this to create a stock that oscillates around a mean that grows exponentially. We’ll model this by making the stock price an exponential function with a parameter in the exponent. Every day this parameter grows by .001; however the actual value of the stock is a random variable that we will model similarly to the mean but by bootstrapping.

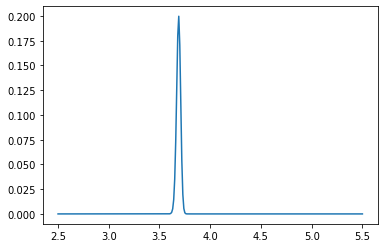

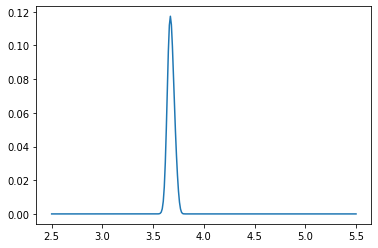

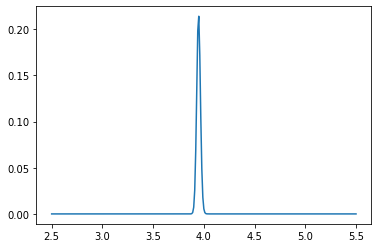

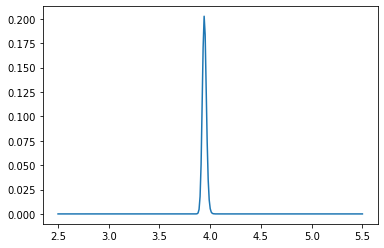

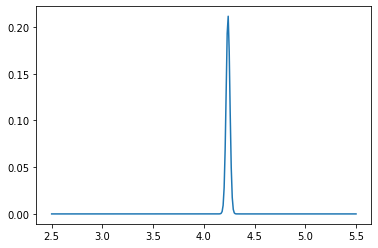

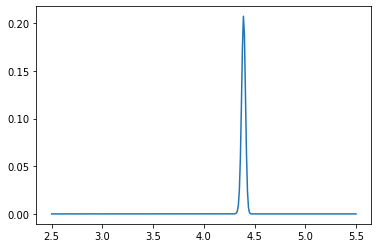

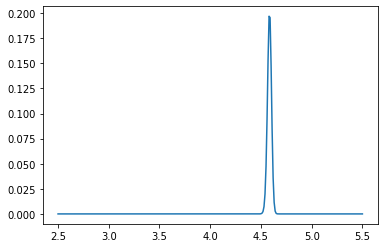

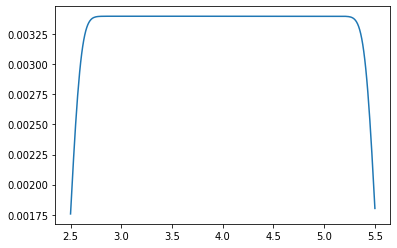

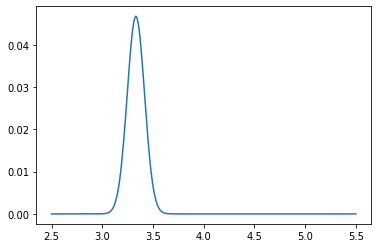

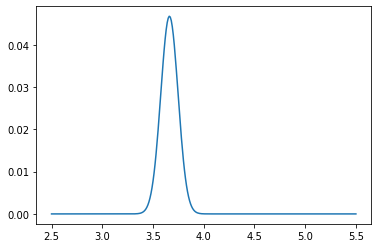

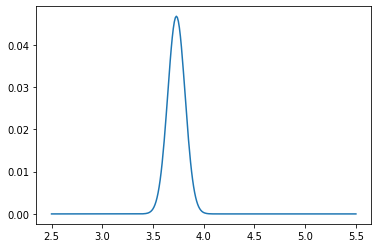

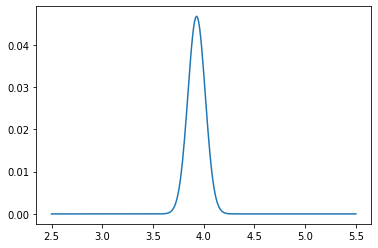

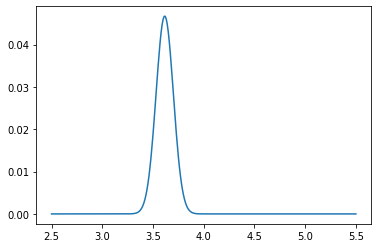

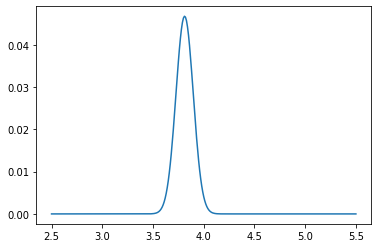

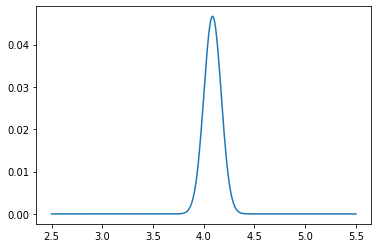

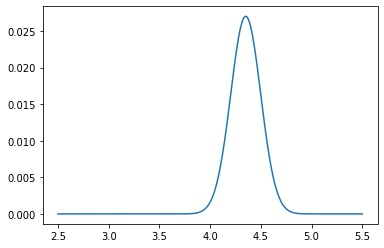

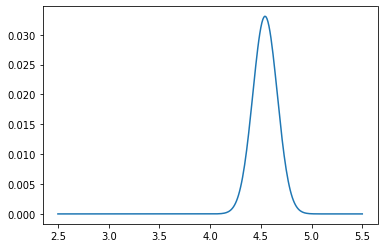

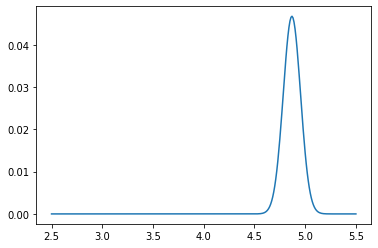

[34]:

from scipy.stats import norm

# Particle filter

pf_index = np.linspace(2.5, 5.5, 301)

pf = np.full(301, 1./301.) # A completely naive prior

e_values = [(pf_index * pf).sum()]

log_means = [logs[0]]

mean_gain = first_diff.mean()

log_values = [logs[0]]

sigma = first_diff.std()

ps = [norm.pdf(0, loc=0, scale=5*sigma)]

for count in range(1,1000):

accept=False

log_means.append(log_means[-1] + mean_gain)

# Go through MCMC accept/reject loop

while not accept:

new_log_value = log_values[-1] + np.random.choice(first_diff)

new_p = norm.pdf(new_log_value, loc=log_means[-1], scale=5*sigma)

if new_p > ps[-1]:

accept = True

else:

p = new_p / ps[-1]

accept = np.random.choice([True, False], p=[p, 1-p])

log_values.append(new_log_value)

old_p = new_p

# Applying the likelihood function

if count % 1 == 0:

L = []

for i in range(len(pf_index)):

arr = norm.pdf(np.array(log_values[-1:]), loc=pf_index[i], scale=2*sigma)

L.append(arr.prod())

L = np.array(L)

pf = (5 + L) * pf

# Here we add the drift, which for simplicity we call a random variable X

# If you look carefully, you'll see that it's convolution

new_pf = pf.copy()

for i in range(pf_index.shape[0]):

# i is our index

t = pf_index[i]

t_minus_tau = t - pf_index

P_X = norm.pdf(t_minus_tau, loc=0, scale=mean_gain*np.sqrt(20))

new_pf[i] = (pf * P_X).sum()

pf = new_pf / new_pf.sum()

# And then we normalize the weights so they sum to 1

new_e_value = (pf*pf_index).sum()

e_values.append(new_e_value)

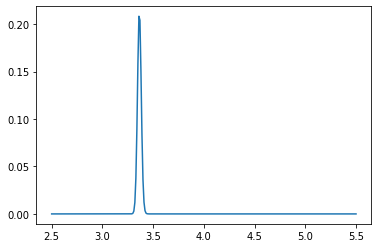

if count % 100 == 0:

plt.plot(pf_index, pf)

plt.show()

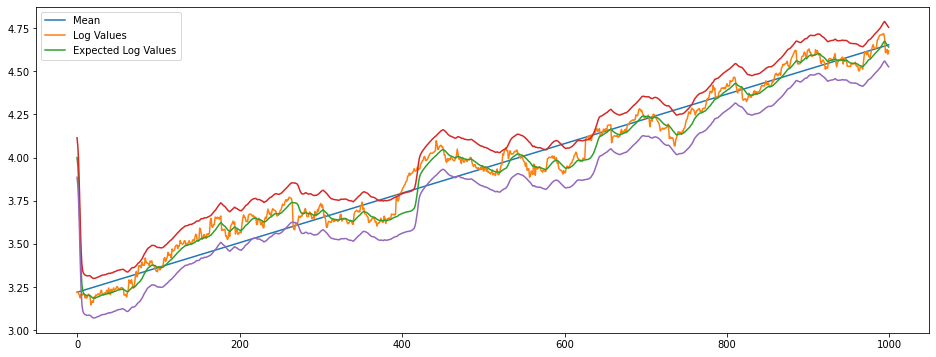

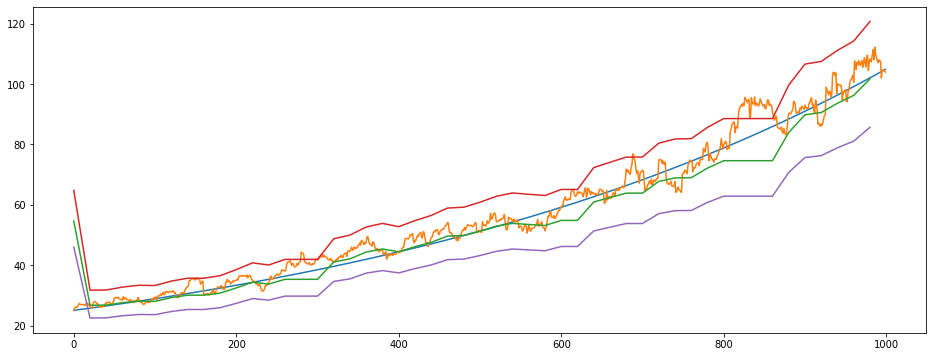

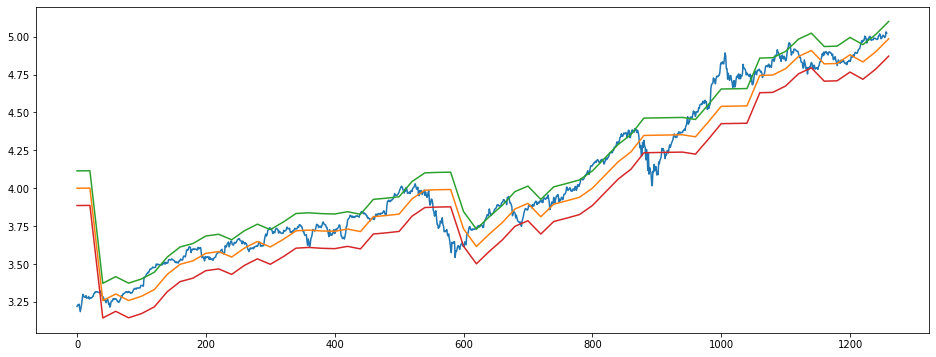

[36]:

plt.figure(figsize=(16,6))

plt.plot(log_means)

plt.plot(log_values)

plt.plot(range(0,1000),e_values)

plt.plot(range(0,1000),e_values+6*sigma)

plt.plot(range(0,1000),e_values-6*sigma)

plt.legend(['Mean','Log Values','Expected Log Values'])

plt.show()

[103]:

plt.figure(figsize=(16,6))

plt.plot(np.exp(log_means))

plt.plot(np.exp(log_values))

plt.plot(range(0,1000,20),np.exp(e_values))

plt.plot(range(0,1000,20),np.exp(e_values+9*sigma))

plt.plot(range(0,1000,20),np.exp(e_values-9*sigma))

[103]:

[<matplotlib.lines.Line2D at 0x20b0eb1edf0>]

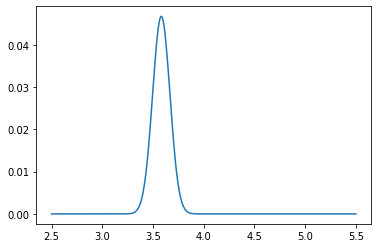

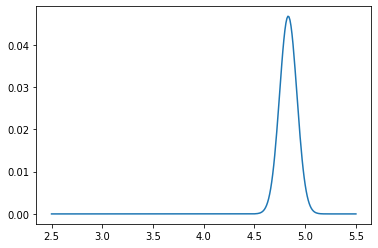

[23]:

from scipy.stats import norm

pf_index = np.linspace(2.5, 5.5, 301)

pf = np.full(301, 1./301.)

e_values = [(pf_index * pf).sum()]

for count in range(len(logs)):

# Applying the likelihood function

if count % 20 == 0:

L = []

for i in range(len(pf_index)):

arr = norm.pdf(np.array(logs[count-20:count]), loc=pf_index[i], scale=sigma)

L.append(arr.prod())

L = np.array(L)

pf = (5 + L) * pf

# Here we add the drift, which for simplicity we call a random variable X

# If you look carefully, you'll see that it's convolution

new_pf = pf.copy()

for i in range(pf_index.shape[0]):

# i is our index

t = pf_index[i]

X = t - pf_index

P_X = norm.pdf(X, loc=mean_gain, scale=sigma*np.sqrt(20))

new_pf[i] = (pf * P_X).sum()

pf = new_pf / new_pf.sum()

# And then we normalize the weights so they sum to 1

new_e_value = (pf*pf_index).sum()

e_values.append(new_e_value)

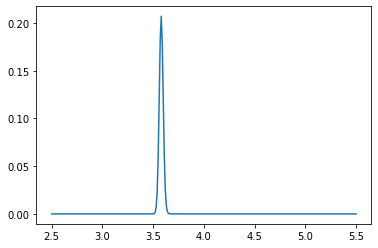

if count % 100 == 0:

plt.plot(pf_index, pf)

plt.show()

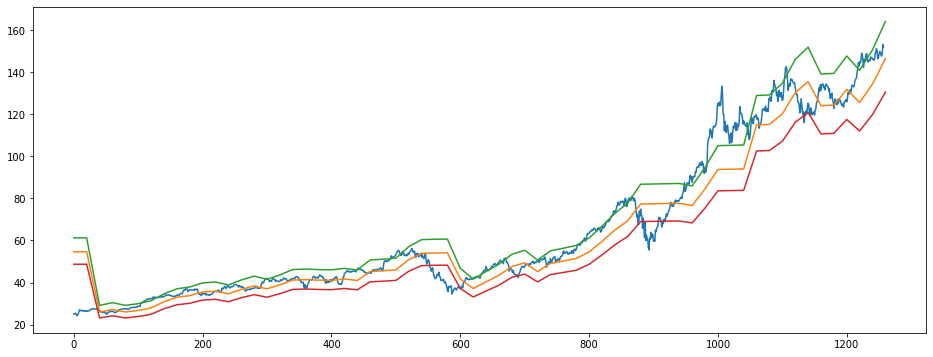

[26]:

plt.figure(figsize=(16,6))

plt.plot(logs)

plt.plot(range(0,len(logs)+20,20), e_values)

plt.plot(range(0,len(logs)+20,20), e_values+6*sigma)

plt.plot(range(0,len(logs)+20,20), e_values-6*sigma)

[26]:

[<matplotlib.lines.Line2D at 0x243980836d0>]

[28]:

plt.figure(figsize=(16,6))

plt.plot(prices)

plt.plot(range(0,len(logs)+20,20), np.exp(e_values))

plt.plot(range(0,len(logs)+20,20), np.exp(e_values+6*sigma))

plt.plot(range(0,len(logs)+20,20), np.exp(e_values-6*sigma))

[28]:

[<matplotlib.lines.Line2D at 0x243a019d760>]

[ ]: